Wait Scroll Down Slowly — The Play-Button is below Watch-OR-Download Your-Movie

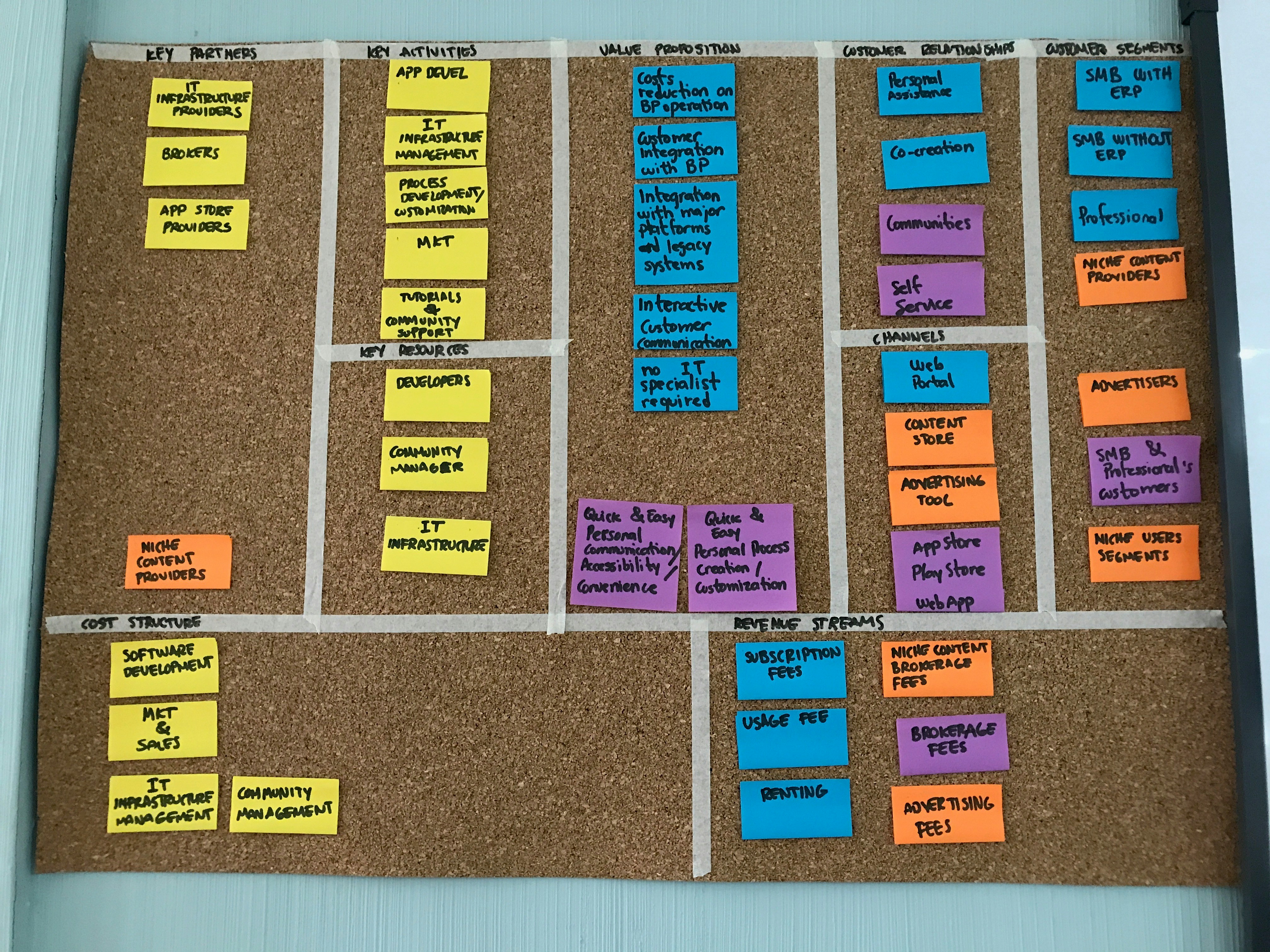

Understanding the Customer Value Proposition (CVP)

The Customer Value Proposition (CVP) is a fundamental concept that defines the unique value a bank offers to its customers. At its core, CVP articulates the benefits and advantages that clients can expect to receive from choosing a particular bank’s products or services. In the highly competitive banking industry, such as that represented by FirstRand Bank, the formulation of an effective CVP is essential in attracting and retaining customers.

A well-structured CVP comprises several key components: the target market, the unique offerings, and the specific benefits provided to customers. The target market encapsulates who the bank aims to serve, which includes both individual and corporate clients. Unique offerings refer to the specific products and services that distinguish a bank from competitors, such as tailored financial solutions, innovative digital banking platforms, or superior customer service. The benefits, on the other hand, emphasize the tangible value these offerings provide, such as cost savings, convenience, enhanced security, and personalized support.

For banks like FirstRand, developing a compelling Customer Value Proposition is crucial to addressing the diverse needs of their target segments. An effective CVP resonates deeply with customers, influencing their perception of the bank and ultimately impacting their satisfaction and loyalty. When customers perceive that a bank genuinely understands their needs and delivers a value that exceeds their expectations, they are more likely to establish a long-term relationship with that institution. Moreover, a robust CVP can enhance brand reputation and create a competitive edge in a crowded marketplace.

In the context of FirstRand Bank, understanding the nuances of Customer Value Proposition can foster deeper insights into customer behaviors and preferences, leading to innovative banking solutions that not only meet but anticipate the needs of customers.

Key Responsibilities of a CVP Manager

The role of a Customer Value Proposition (CVP) Manager at FirstRand Bank encompasses various critical responsibilities that are essential for the organization’s growth and customer satisfaction. One of the primary duties involves designing and developing comprehensive value propositions tailored to meet the diverse needs of customers. This function requires a deep understanding of both the market landscape and customer expectations, enabling the CVP Manager to create offerings that resonate with the target audience.

Conducting thorough market research stands as another pivotal responsibility. This research is essential for gaining insights into customer behaviors, preferences, and evolving needs within the banking sector. By employing qualitative and quantitative research methods, the CVP Manager can identify gaps in the market as well as opportunities for innovation. This helps in aligning the bank’s offerings with market demands and customer sentiments, ensuring that FirstRand Bank remains competitive.

Moreover, a CVP Manager must align these value propositions with the broader business objectives of FirstRand Bank. This alignment is crucial as it ensures that the developed strategies not only cater to customer needs but also support the overall goals of the organization. This requires collaboration with various teams across the bank, including marketing, product development, and sales, establishing a holistic approach to customer engagement.

Collaboration and effective communication with various stakeholders are integral for the CVP Manager. By working harmoniously with different departments, the manager can facilitate the seamless implementation of value propositions, driving customer growth and retention. This multifaceted approach enables the CVP Manager to play a strategic role in enhancing the bank’s customer experience and fostering enduring relationships with clientele.

Skills and Qualities Required for Success

To excel as a Customer Value Proposition Manager at FirstRand Bank, a diverse skill set and a specific set of personal qualities are essential. A core requirement is strong analytical skills, enabling the manager to dissect market research, customer feedback, and competitive analysis. This proficiency allows for the identification of emerging trends and the evaluation of the effectiveness of current propositions, ensuring that the bank remains at the forefront of customer needs.

Strategic thinking is another critical skill necessary for this role. A successful manager must be able to develop long-term strategies that align with both the bank’s objectives and customer expectations. This involves not just planning but also the adaptability to modify strategies as market conditions change. The ability to discern strategic priorities helps in creating compelling value propositions that resonate with clients and stakeholders alike.

A customer-centric mindset is paramount. The Customer Value Proposition Manager must empathize with clients to understand their pain points and desires. This approach cultivates a culture of customer engagement, ensuring that propositions are not just crafted in isolation but are reflective of the actual needs of customers. Coupled with this is the ability to interpret data effectively; the manager should leverage data insights to support decision-making and to forecast potential impacts of proposed strategies.

Furthermore, exceptional communication skills are crucial in presenting these value propositions. Whether engaging internal teams, stakeholders, or customers, the ability to articulate concepts clearly and persuasively influences successful collaboration and buy-in for initiatives. An effective manager not only conveys ideas but also listens actively, ensuring that feedback is integrated into future strategies, thereby fostering continuous improvement.

Impact of CVP on Business Growth and Customer Retention

The integration of a well-defined Customer Value Proposition (CVP) can play a pivotal role in fostering business growth and improving customer retention rates. Organizations, including financial institutions like FirstRand Bank, have recognized that a robust CVP not only addresses customer needs but also builds a foundation for sustainable relationships. By clearly articulating the value that a company offers, a CVP helps differentiate its services in a crowded marketplace, appealing directly to the preferences and concerns of the target audience.

One illustrative case study can be observed from FirstRand Bank, which has successfully implemented a customer-centric approach by refining its CVP. The bank focused on tailored financial solutions that cater specifically to various customer segments, enhancing the overall customer experience. By doing so, FirstRand Bank increased its market share while also cultivating loyalty among existing customers. This strategic alignment between the organization’s offerings and customer expectations underscores the importance of a CVP that adapts to the evolving demands of the financial services sector.

Moreover, market trends indicate that customer preferences are continually shifting, driven by technological advancements and changing economic conditions. To remain competitive, organizations must regularly reassess and adapt their CVPs in response to these fluctuations. For example, banks that leverage digital tools to enhance their value propositions typically observe higher engagement levels. This adaptation not only helps in retaining existing customers but also attracts new ones by addressing the dynamic landscape of customer expectations.

In conclusion, a thoughtfully crafted Customer Value Proposition is instrumental for businesses aiming to enhance growth and retention. By aligning offerings with customer needs and staying attuned to market trends, organizations can sustain their relevance and establish a strong foothold in their respective industries. FirstRand Bank’s commitment to continuously refine its CVP serves as a testament to the value that a strong customer focus can deliver in achieving long-term success.